Citibank is known as one of the largest banks in the world. It currently operates from almost all the continents in the world and has more than 4,600 branches throughout the world. It encourages its customer to use the facilities of its credit cards. Citibank customers, who have Citi credit card, can pay their bills online, buy anything online, and check statements online.

One of the key features of having a Citi credit card is to get a constant update on your account. Apart from that, you can do business using their card too. It’s more than just easy credit transaction once you enroll for Citi credit card, it’s a key to unlock unlimited resources of the transaction, controlled finance, and other open figures fall in for other clients. In this post, we are going to discuss more the basic procedures of using Citi Credit Card.

Why to Choose Citibank Credit Card:

If you are looking for a credit card then you can choose Citibank credit card to fulfill your financial needs. You can choose Citibank credit card for the below obvious reasons.

- Low-interest

- No or, minimum annual fees.

- Easy to apply.

- Reward son every purchase.

- Applicable to all kind of purchases.

Eligibility Criteria for Citibank Credit Card.

To apply for a Citibank credit card you need to meet the below eligibility criteria.

- Your age needs to be more than 18 years.

- You should have good credit health.

- You need to a resident of US.

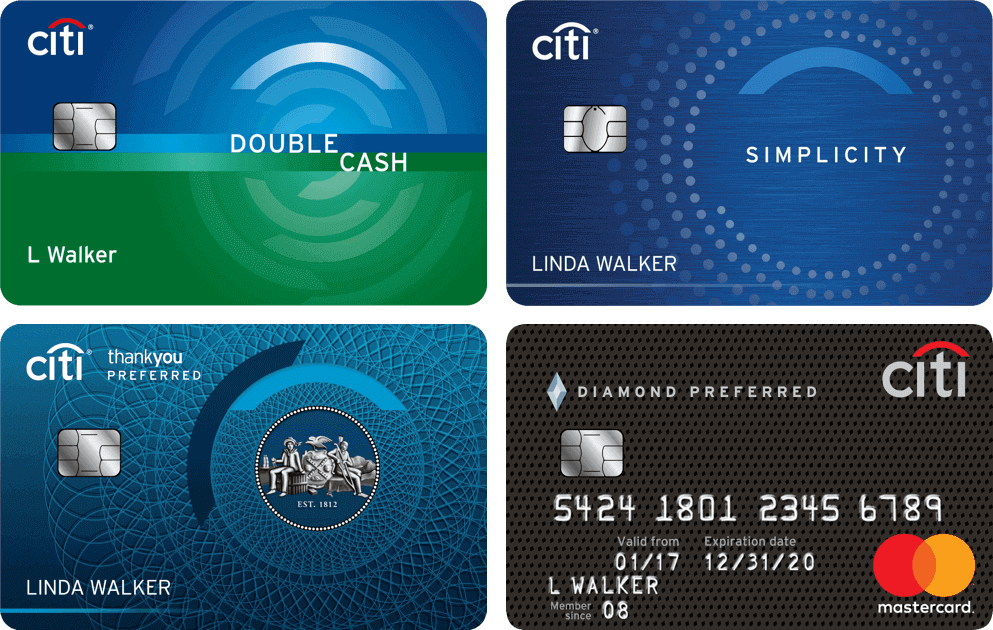

Types of Citibank Credit Cards:

Citibank has a wide range of credit card collection, the customer can choose from those cards according to their need and usage.

- Citi Double Cash Card: Citi Double Cash Card is one of the most popular cash back cards.

- Benefits:

- You earn 1% unlimited cash back on all your purchases and an additional 1% on payments based on those purchases.

- Special access to purchase tickets to thousands of events annually, including presale tickets and VIP packages to concerts, sporting events, dining experiences, plus complimentary movie screenings and more.

- $0 liability for unauthorized charges.

- EMV Chip Technology makes your card globally acceptable.

- Citi Simplicity Card: This is the only card with no late fees, no penalty rates,and no annual fee.

- Benefits:

- $0 Liability on Unauthorized Charges.

- No annual fees.

- You can choose your payment due date according to your convenience.

- Automatic account alert to keep you stress-free.

- 27/7 customer service.

- Benefits:

- Benefits:

- Citi AAdvantage Platinum Select World Elite Mastercard:

Now you can save your money with

-

- Benefits:

- You can earn 50,000 American Airlines AAdvantage bonusmiles after making $2,500 in purchases within the first 3 months of account opening.

- No Foreign Transaction Fees on purchases.

- An annual fee is $99/- which will be waived for first 12 months.

- You can earn 2 AAdvantage miles for every $1 spent at gas stations.

- Earn a $100 American Airlines Flight Discount after you spend $20,000 or more in purchases during your card membership year and renew your card.

- Benefits:

Rate and Fees:

With excellent advantages, there is some rate and fees or the Citibank credit cards and you should know about it:

- Annual Percentage Rate:

- Annual Percentage Rate (APR) for Purchases and balance transfer: your APR will be 16.24% to 26.24%, based on your creditworthiness

- Annual Percentage Rate for Cash Advances:24% to 26.24%, based on your creditworthiness.

- Fess:

-

- Balance Transfer: Either $5 or 5% of the amount of each transfer, whichever is greater.

- Cash Advance: Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Late Payment Fee: up to $39

- Returned Payment Fee: up to $39

How to Apply for Citibank Credit Card:

Want to take the convenience of the service is provided by the Citibank through their credit card service then you should apply for it first. To apply for a Citibank credit card you should follow the below process:

- Open the official website with the link online.citi.com/US/login.do

- Click on the Credit card option.

- Click on the “View all Credit Cards” option.

- Select the credit card you want to apply for and click on the “Learn more & Apply” option”

- Now click on the “Apply Now” option.

- Enter your personal information, address details, income details and click on the “Submit” button.

How to login to Citibank Credit card account:

The best part of logging into Citi card’s account is that you can do it from any device that is connected to reliable internet service. You can use your Citi credit card for various uses. We have put together a few simple steps for your reference mentioned below:

- First, open a browser and open the official website with the link online.citi.com/US/login.do

- Click on the Credit card option.

- Enter your User Id and password then click on the “Sign On” option.

How to Reset Forgotten Username and Password?

It’s easy nowadays to forget the user ID and password as we use a lot of online account for various purposes. However, Citi card has made this thing easy for you in case you forget their login credentials. Just follow the below steps to regain access for your Citi Card account:

- First, open a browser and open the official website with the link online.citi.com/US/login.do

- Click on the Credit card option.

- Then click on the “Forgot Username/Password?” option.

- Enter your card number and click on the “Continue” option.

How to Activate Citibank Credit Card:

Now with the online facility of the Citibank, you do not need to go anywhere to activate your card. For activation of your credit card just you need to follow the below process:

- First, open a browser and open the official website with the link online.citi.com/US/login.do

- Click on the Credit card option.

- Now click on the “Activate a Card” option.

- Enter your card number and click on the “Continue” option.

How to Register for Citibank Credit Card Account:

Want to make an online payment for your credit card or want to manage your account, and then you should sign up first to the online account: Just follow the below steps:

- First, open a browser and open the official website with the link online.citi.com/US/login.do

- Click on the Credit card option.

- Click on the “Register Now” option.

- Enter your card number and then click on the “Continue Set Up” option.

Citi Card Online Login Features:

Citi Card provides excellent services to pay bills through a desktop or mobile app as well. It is a natural and secure way to manage your account without the need to visit a branch every time you need to use the service. Here are lists of few of them:

- You can view your due payments and also schedule a payment.

- It enables you to check your balance or credit.

- It allows you to access your statements and manage the unbilled amount.

- You can request a balance transfer and get account information through an email.

- You can communicate with customer care through secure texting.

- Get statements only online with its all-electronic program.

- Discover new ways to earn rewards and save on dining & entertainment.

How to Pay Citibank Credit Card Bill:

So there are two options to pay your Citi Credit card bill online

- From your Citi Bank account – Citi bank account holders can pay their Citi credit card payments quickly from their current or savings bank account. It provides Internet banking facilities to make payments conveniently.

- Online Banking – with the online banking account of CitiBank, you can pay directly. First, you need to login to your account and view bill amount, credit card statement, payment due date etc.

- Mobile Banking – you can download CitiBank mobile application or visit the website from your smartphone to make payments on your credit card any corner of the world. You can log in to your account through your mobile or tablet.

- From Your other bank account – Citi Bank also provides you to pay your credit card bill from another bank account as well.

- NEFT – National Electronic Fund Transfer helps make payments on your credit card from any other bank account

- RTGS – it stands for Real Time Gross Settlement transfers and can be used to pay your credit card bill

- E-PAY – Epay is an online web page service offered by Citi Bank for its customers to make credit card payments online from another bank account

Conclusion

Well, that is it from our side that we could tell you. Hopefully, this post will help you greatly. If you need more information about CitiCard, you can visit the official website of Citi Bank Credit Card. Thank you all.

Reference: