Guidelines To Cenlar Login For Central Loan Administration & Reporting

If you are in need for mortgage loan you can always find the safe and secure way with Cenlar. This is one of the leading company providing mortgage sub-services in the United States. The company has its headquarters in Ewing, New Jersey. Cenlar was founded in 1912. The main work of Cenlar services is residential mortgage. Apart from this, they also have services for mortgage companies, banks, credit unions, thrifts. With that, there are many programs offered by Cenlar company, such as cash management, default administration, escrow administration, customer communications and support, investor accounting and reporting, payoffs and satisfaction, special products, regulatory compliance and reporting, and comprehensive reporting on various kinds of aspects of sub servicing relationships.

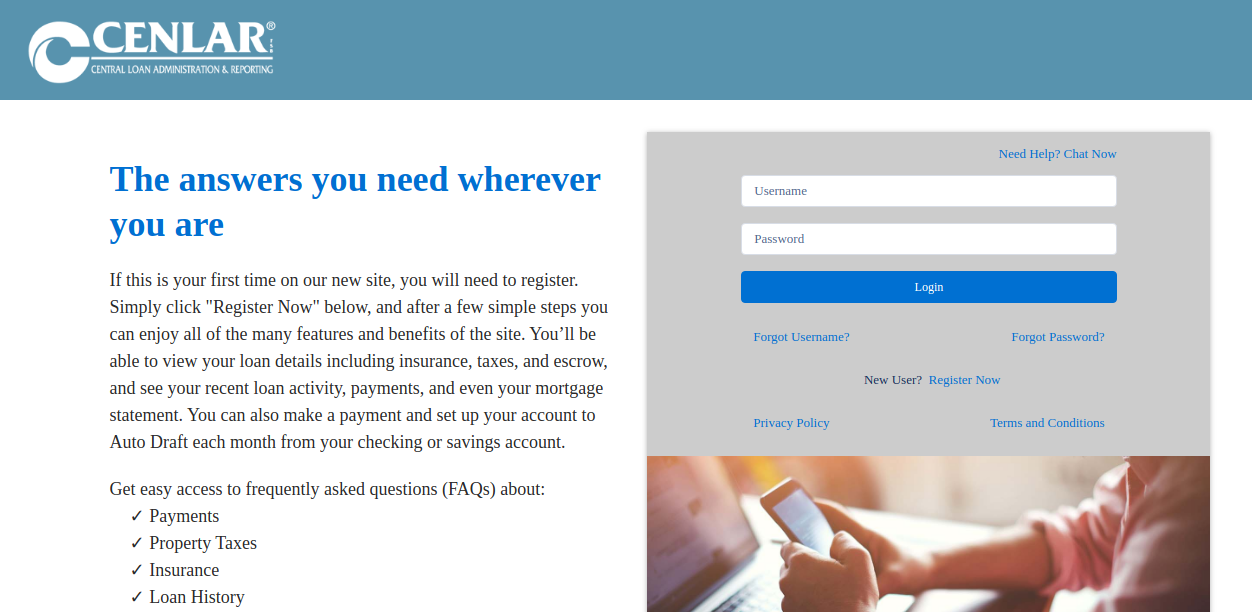

Cenlar Login is an official Central Loan Administration and Reporting Mortgagee Clause. Of course, you get to go online in order to access the site. Also, the Central Loan Administration & Reporting is reachable at LoanAdministration.Com. Paying your loan becomes one of the most crucial responsibilities. In this case, you get to do it in the correct way. One of the best ways to do so is by going to Cenlar Login portal at LoanAdministration.Com. As you know, it is the official Central Loan Administration & Reporting site where you can also give some Cenlar Reviews.

There are some advantages as well as features like Cenlar Class Action Lawsuit, Cenlar Mortgage Doxo, complete with Central Loan Administration and Reporting Mortgagee Clause.

To get the service of Cenlar, you need to login and register with the account first. From there you will get to know more about the mortgage options. Here, check out the very process and more.

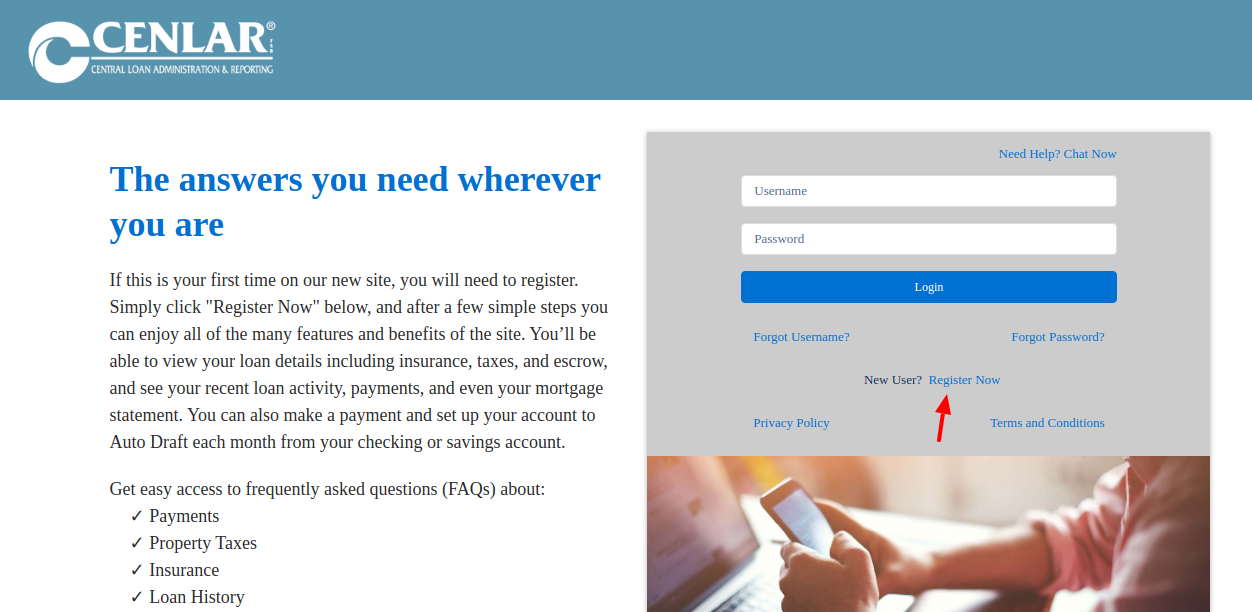

Register for Cenlar Login

At the time of registering to the account, you need to go to, www.loanadministration.com Here, at the right side of the page, under the login blanks, you need to click on, ‘Register now’.

On the next page, at the middle, you need to type,

-

Loan Number

-

Social Security Number

-

Then, click on ‘Submit’.

Logging into the Cenlar Login Portal

For the login, you need to type on the browser, www.loanadministration.com

Here, at the, right side of the page, you will get the login blanks.

In here, you need to type,

-

The username

-

The password

-

Then, click on, ‘Login’.

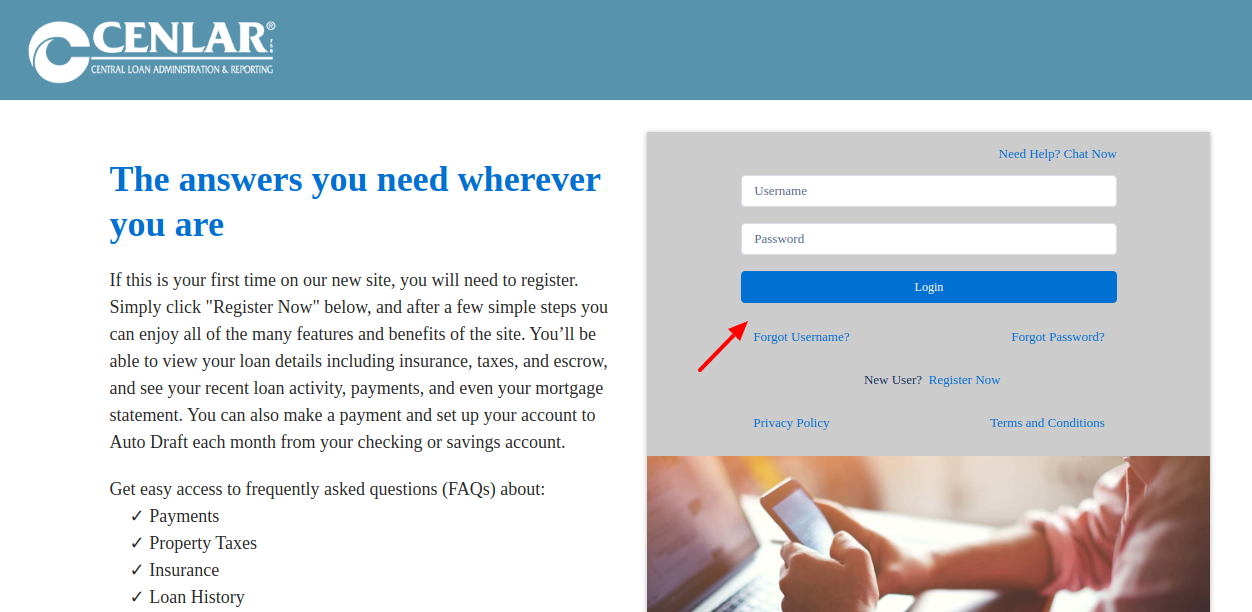

Forgot login info

In case you have lost the login details of , then you need to go to the same page of login, here, under the ‘Login’ blanks, you will get the option for, ‘Forgot username?’.

Here you have to input

-

Email

-

Loan Number

-

Last four digits of Social Security Number

-

After typing this you have to click on, ‘Submit’.

For Password, click on ‘Forgot password?’. Then, type,

-

The username

-

The registered email

-

After typing this you have to click on,‘Submit’.

Do follow the prompts after this and you will get back the details.

The things you can access by the Cenlar login portal

You have got clear information about Cenlar login. And now, how about knowing more about the benefits and advantages? Yes, there are some features which you can use at the portal which brings you a lot of advantages. Here they are:

-

Payments

Here, you can start to process the payment. If you see, there are some steps which you must take in order to complete the payment. It is good as you can pay the loan online. It is going to save your time as well as energy.

-

Property Taxes

You can also get more advantages in property taxes. Yes, you can check your property taxes at the same portal. For the next, you can also include the taxes into your payment process.

-

Insurance

This is also good for you to check your insurance. Here,www.loanadministration.com portal offers you a bunch of information. Enjoy exploring!

-

Loan History

For you who need to get the details of loan history, you don’t have to worry. The Loan Administration site also offers you the access. In this case, you can check the previous loans history just in case you need them.

-

Automatic Payments

If you are such a businessman who is busy, you can use this special feature. Yes, you can pay a certain loan automatically. In this case, you just have to set the payment method and so on. Yet also, you are going to get notifications about the payment due date and so on.

Benefits of Cenlar loan handling

There are a host of good reasons to have Cenlar handle your loan servicing operations. From community banks to the largest loan aggregators, clients enjoy significant benefits by allowing Cenlar to handle the job.

Key benefits include:

-

Superior customer service: Dedicated and consistently high-quality customer service results in better service relations.

-

Fully customized servicing solution: Your company’s needs are unique and Cenlar’s innovative and flexible design enables you to create the program you need.

-

Real-time flexibility: As your portfolios change and business demands vary over time, Cenlar’s servicing capabilities adapt instantly to meet your needs and offer the perfect fit.

-

Reduced capital outlay: We invest in technology, training and telephony systems so that you don’t have to. The necessary resources and infrastructure are already in place and fully operational, so everything it takes to service your loan portfolio well is ready when you are.

-

Default management: You don’t have to get bogged down with managing the servicing of delinquent loans and complex default servicing activities. We can ease the process by providing professional handling of the default loan administration functions, which in turn allows you to focus on your core business.

-

Reduce regulatory compliance servicing risk: The constant changes in regulatory requirements at all levels can pose a threat to your business. Cenlar’s knowledgeable compliance representatives give you the confidence that you are always in compliance with applicable servicing regulations.

Cenlar branded service option

Cenlar offers you a fully customizable loan servicing program that adapts to your evolving needs. We work with you to design a program based upon your specific loan products and requirements. We integrate the strengths of our business processes, our proprietary technology, and experienced management and servicing teams to provide you a branded solution exceeding your expectations. By selecting Private Label Subservicing, your hard work and commitment to your brand remain intact as we keep your name and identity in front of your customers in all interactions.

-

A dedicated toll-free number greets your customers with your name; outbound calls are identified as calls from you.

-

Your name and logo will appear on all correspondence and printed materials (payment books and statements, letters, notices, ARM loan changes, year-end statement and escrow analysis, and more).

-

Customer payments are made payable to your organization; payment drafting from checking or savings accounts will have your name recorded on your customer’s statement.

-

Monthly credit bureau reporting appears in your name.

-

Direct call transfer capability to your organization will give your customers the opportunity to research sale or refinance opportunities directly with you.

-

Internet-based loan-level access, fully customized to your website, is available for you to view your portfolio and for your customers to access their loan.

Also Read : The Comprehensive Guide To Spservicing Account Login

Core services of Cenlar

-

Customer Communications and Support

-

Escrow Administration

-

Cash Management

-

Investor Accounting and Reporting

-

Default Administration

-

Payoffs and Satisfactions

-

Special Products

-

Regulatory Compliance and Reporting

Customer support

To get help from Cenlar directly, you can contact them on the toll-free number, 1-800-223-6527. Or you can send an email to, customerservice@loanadministration.com.

Reference :