Get To Apply Now For $1,000 Easy Cash Loan

Now and again quick money is expected to assist when there’s no other option. So, it sure is something to be thankful for Up Lending gives off an impression of being “up” to the test of giving people simple access to the crisis supports they need in such an occurrence. The individuals who are needing a credit of up to $1,000 can start by heading off to the Easy Cash Match page and rounding out a short structure with an email address, postal division, and advance sum (extending from $100 to $1,000 in products of $100) before tapping the Get Cash Now catch to continue with the application procedure. The individuals who have just enlisted and are returning to begin another application can tap the Returning Customer interface posted at the highest point of the Easy Cash Match page to enter a telephone number and last 4 digits of a Social Security Number to access an efficient pre-filled application structure.

More to know about lenders

-

Works with a variety of different lenders to help borrows find a match

-

Credit history does not impact the borrower’s ability to find a loan

-

The full terms and conditions of each loan are provided (due diligence!)

-

Provides resources to help borrowers make educated financial decisions

-

Funds can be had by the next business day

Borrowers with questions about the loan process can try clicking the View FAQ button to bring up a list of Frequently Asked Questions. The Terms & Conditions link posted at the bottom of the Easy Cash Match page is also a good resource for more information about Up Lenders. Those who wish to follow the company on social media can do so by clicking the provided icons of Facebook, Twitter, and Google Plus.

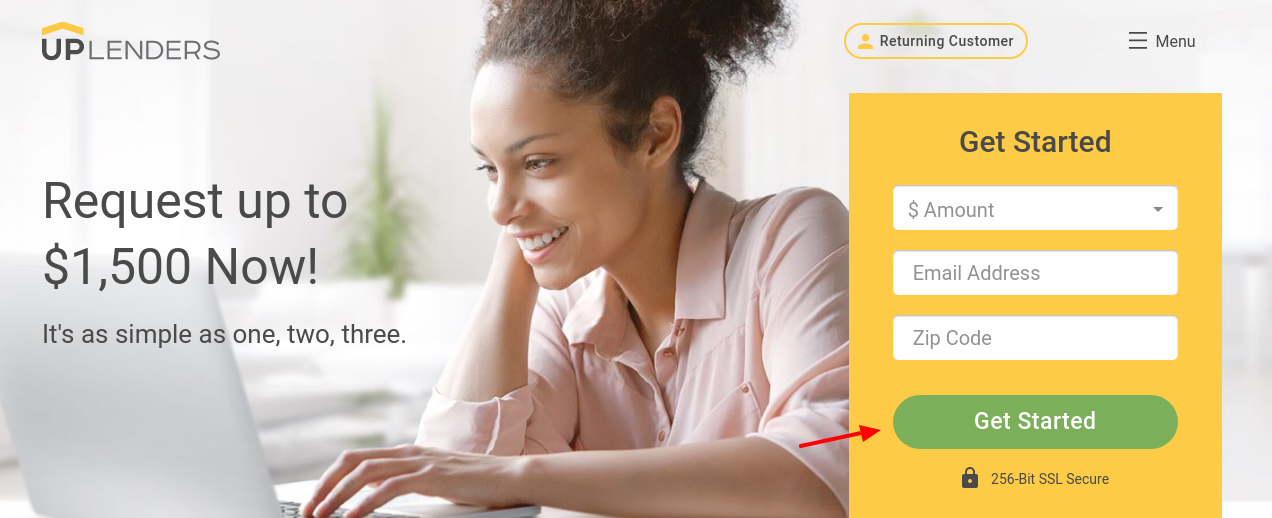

Apply for Uplenders loan

For this visit, when you are not a returning customer, uplenders.com

Here, at the middle right of the page, you will get a box, here type,

-

The amount

-

Email address

-

The zip code

-

Then, click on, ‘Get started’ in green.

Start to follow the prompts after this.

For returning customers, click on, ‘Returning customer’ at the upper side of the block.

You will get a similar block, and here enter,

-

The phone number

-

Last 4 digits of your SSN

-

Then click on, ‘Login’.

You will be logged in.

Check the Uplanders rate

For this go to, uplenders.com

Here, at the middle right side, you will get the menu sign, clicking on it will get you the drop-down, there click on, the 10th option, ‘Rates & fees’.

-

On the next page at the middle left side type your location, and you will get to see the rates in your area.

Also Read : Hulu Streaming Service Account Login Guide

Additional info on Uplenders loan policies

-

In most cases, the criteria you must meet in order to be eligible for a short-term loan are the same across all lenders. You must be 18 years of age or older, a legal resident of the United States, have a steady source of monthly income (e.g. employment, SSI, etc.), have a bank account that is not currently overdrawn, and have a working telephone number and email address. Some lenders may provide you with funds even if you are not employed, but you must be able to show proof of steady income from various sources such as SSI or unemployment. Remember that each lender has its own rules and regulations and uplenders.com cannot guarantee that a lender will approve you for a loan.

-

There are several factors that will determine the ultimate cost associated with obtaining a short-term loan. uplenders.com does not determine these costs, and this information will be made available to consumers by their chosen lenders before they accept their loans. Some of the things that may affect the cost of a loan include the APR, the finance charges, whether the loan is paid on time, rollover requests, state regulations and more. It is important for consumers to review all of this information very carefully before they accept a loan to ensure they are not surprised by any changes in the future.

-

To request a short-term loan with uplenders.com, all you have to do is fill out our short form. The only information we will ask you to provide is the information our network of lenders needs to make a decision. The form only takes a few minutes to fill out, and once it is completed, it will be forwarded to our network of many lenders for review. You will then begin to receive offers for loans, and if you are interested in one of these offers, you can visit the lender’s website to read the terms associated with it. After you have agreed to the terms, you will be asked to provide an electronic signature. Finally, your funds will be deposited into your bank account as soon as the next business day.

-

While uplenders.com recommends that consumers only have one outstanding short-term loan at any given time, state regulations and individual lenders may allow for two or sometimes even three loans. If this is the case and you request a loan while you already have a loan outstanding, you will be required to provide this information to your lender. In states where multiple loans are allowed, lenders and borrowers may not exceed state loan limits across the total of the loans. Many lenders will not provide more than one loan to any consumer at any given time; lenders reserve the right to deny a consumer a loan if they already have a loan outstanding, as well.

-

You would not overdraw your checking account or get a loan from your credit card without good reason, so the same principles should be applied to short-term loans. They are designed to be used during financial crises as a short-term solution and never as a way to dig oneself out of a mountain of debt. We encourage consumers to use their loans responsibly and never request money for frivolous spending. Consumers who have serious financial trouble should consider hiring a professional credit counselor to help them prepare budgets and pay off debt.

Also Read : How To Pay Your AT&T Bill Online

Contact info

To get further help, you can send an email to, contact@uplenders.com. Or you can write a mail to, 8 The Green, Dover, DE 19901.

Reference :