Manage your Capital One Credit Card Account:

Capital One Financial Corporation is a bank holding company or America. Especially this bank holding company is operating or serving with credit cards, auto loans, banking, and savings accounts. Capital One was created in the year of 1994 in Richmond, Virginia, the United States by Richard Fairbank and Nigel Morris. Capital One is a public company and belongs to the financial services industry. And currently, Capital One is headquartered in McLean, Virginia, United States.

Cards Offered by Capital One:

If you are wishing to get a Capital One Bank Credit Card then you have to know the credit cards offered by Capital One Bank. And there are several types of cards and. The types of cards are available at the current time are travel rewards credit cards, cash back credit cards, credit building cards, and business rewards credit cards. Credit Cards Offered by Capital One Bank are discussed in brief underneath.

Venture Rewards Credit Card:

- This is a travel reward credit card.

- You can earn unlimited 2X miles per dollar on every purchase, every day.

- There will be an opportunity to earn 1 lakh bonus miles when you spend $20 thousand on purchases in the first year after getting the card in hand.

- In the first 3 months, you can earn 50 thousand miles by spending $3 thousand.

- Earn up to $100 credit for global entry.

- The credit level of this particular card is excellent.

- You have to pay 17.24% to 24.49% variable APR.

- The transfer fee is nil and the annual fee is $95.

VentureOne Rewards Credit Card:

- You can earn 1.25 miles per dollar on an everyday purchase.

- 20 thousand bonus miles once you spend $500 on purchases within the initial 90 days after getting a VentureOne Credit Card.

- There is no travel credit for you.

- This card comes with an Excellent credit level.

- 49% to 25.49% variable APR is there for using this card with no transfer fee along with this transfer APR.

- For using this card no annual fee has to be paid.

VentureOne Rewards for Good Credit:

- You can earn 1.25 miles per dollar on an everyday purchase.

- 20 thousand bonus miles once you spend $500 on purchases within the initial 90 days after getting a VentureOne Credit Card.

- There is no travel credit for you.

- This card comes with an Excellent credit level.

- 99% variable APR is there for using this card with no transfer fee along with this transfer APR.

- No annual fee has to be paid for using this card.

SavorOne Rewards for Good Credit:

- You can earn unlimited 3% cashback on your diners, streaming, entertainment, and grocery stores.

- And also earn 1% cashback on other purchases and 8% cashback on purchasing tickets on vivid seats.

- No offer is there for new cardholders.

- The credit level of this card is good.

- This card comes with a 26.99% variable Purchase and Transfer APR and with no Transfer fee.

- No annual fee is there to pay for using this card.

SavorOne Rewards:

- You can earn unlimited 3% cashback on your diners, streaming, entertainment, and grocery stores.

- And also earn 1% cashback on other purchases and 8% cashback on purchasing tickets on vivid seats.

- You can earn a one-time bonus offer as a $200 cash bonus on spending $500 within 90 days from getting your SavorOne Credit Card.

- The credit level of this card is excellent.

- This card comes with a 0% introductory APR for the first 15 months and then you have to pay 15.49% to 25.49% variable Purchase and Transfer APR and with no Transfer fee.

- There is no annual fee for using this card also.

Savor Rewards:

- You can earn unlimited 4% cashback on your diners, streaming, entertainment, and 3% at grocery stores.

- And also earn 1% cashback on other purchases and 8% cashback on purchasing tickets on vivid seats.

- You can earn a one-time bonus offer as a $300 cash bonus on spending $3000 within 90 days from getting your Savor Rewards Credit Card

- The credit level of this card is excellent.

- This card comes with 15.99% to 24.99% variable Purchase and Transfer APR and with no Transfer fee.

- You have to pay $95 as an annual fee for using this card.

And there are many other cards offered by Capital one which can be explored by visiting the official website of Capital One. And you can visit the website by browsing this link www.capitalone.com/credit-cards. Choose your preferable segment of credit cards like credit building, cashback, dining and entertainment, and travel rewards.

Capital One Credit Card Application:

To get a Capital one Credit card you have to make an application first. Without applying for a credit card from Capital one you can’t be able to use one. And the application procedure is illustrated below in very simple steps.

- At first, you have to visit the Capital One Credit Card website by browsing this link www.capitalone.com/credit-cards.

- And then you have to choose your preferable credit card type like credit building, cashback, dining and entertainment, and travel rewards.

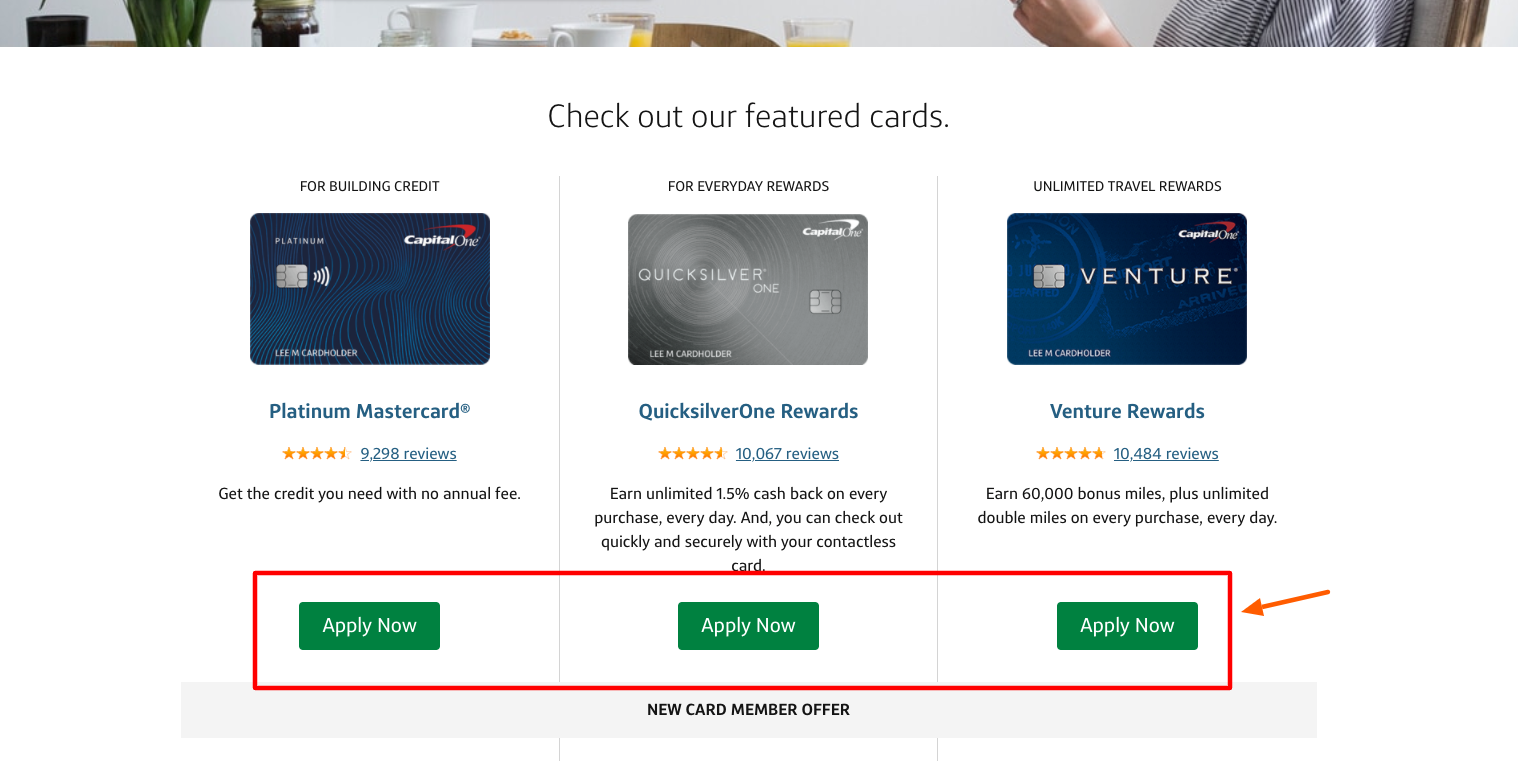

- Then you will be redirected to another page where you have to choose your credit card by clicking on the “See Cards”.

- Now you will reach another page and then you have to scroll down that page and click on the “Apply Now” button to start the application process as per your choice.

- Then enter details like Legal First Name, MI, Legal Last Name, Date of Birth, and Social Security Code.

- And then confirm your citizenship and click on the “Continue” and follow the rest instructions to complete the application procedure.

Also Read: Best Online Guide for VS Credit Card Login

Capital One Credit Card Activation:

After getting a Capital One Credit Card you have to activate it. Because without activating a credit card you can’t be able to use it. And the activation process can be done in three ways. And the ways are online, by mobile app and telephonic. The activation procedure is undermentioned.

Online:

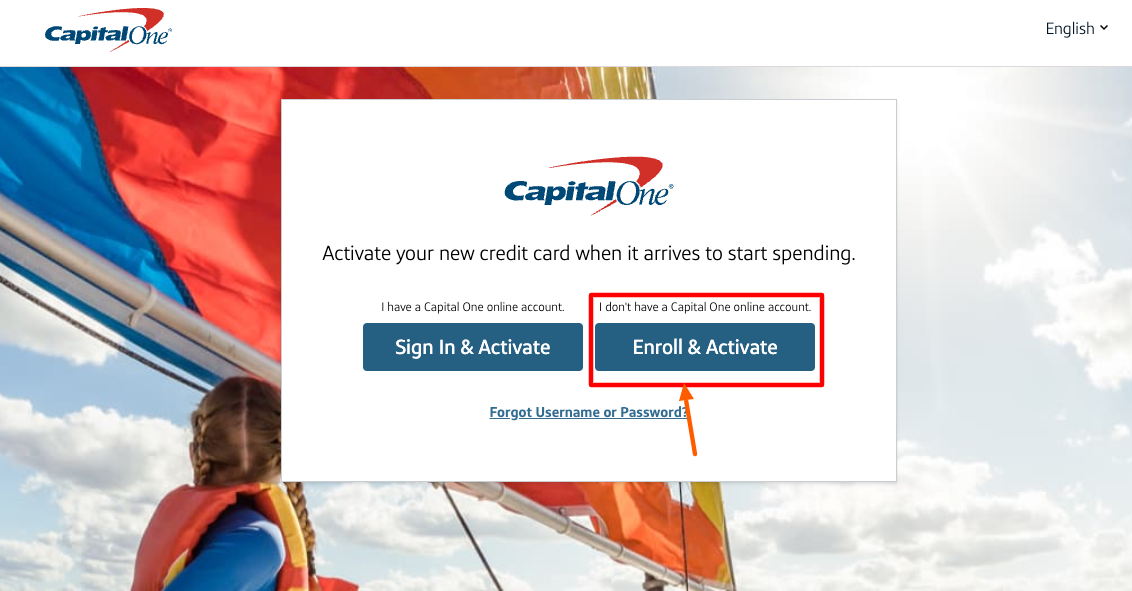

- To activate your card online you must have an online account in Capital One.

- And to activate your you have to visit the activation portal of Capital One Card Activation portal.

- And you can be able to reach the activation portal by clicking on this link capitalone.com/activate.

- Then you have to click either the “Sign In & Activate” button or the “Enroll or Activate” button.

- After choosing an option do as per the directions and activate your Capital One Credit Card online.

By Mobile App:

Also, you can activate your Capital One credit card through the Capital One bank’s mobile app. And to use this process you have to open the play store for android phones or the app store for iOS phones. And then download the app and complete the login process by using the username and password and then activating your card.

By Phone:

If you cannot be able to do the above-mentioned procedures to activate your Capital One Credit Card then you can use this way to activate your card which is to make a call. To use the telephonic way, you have to dial 1-800-227-4825 and follow the instructions to activate the card.

Capital One Online Account Opening:

To manage your card, you have to open an online account in the capital one online banking facility. After creating an online account, you can be able of managing your cards and funds affiliated or connected with Capital One easily online without visiting any branch or ATM. And the account opening process is mentioned underneath.

- To open up a new account in the Capital one online access. You have to visit the official website of Capital One by browsing this link www.capitalone.com

- And after reaching the website you have to click on the hyperlink available as “Set Up Online Access” under the blue-colored Sign In button.

- And then enter details like Last Name, Social Security Number or Bank Account Number, and your Date of Birth.

- Then click on the “Get Started” button and then follow the directions to complete the account opening or set up process.

Capital One Online Account Login:

After you set up online access you have to go through the sign-in process. And then you have to complete the login process whenever you want to access your account or manage your cards. And the steps to complete the sign-in process.

- First of all, you have to visit the Capital One website. And that can be done by browsing this link www.capitalone.com.

- After reaching the website you have to enter your Username and Password in the given places.

- And after entering the details you have to make a click on the “Sign In” button to complete the sign-in process to access your account

Capital One Online Account Login Credentials Recovery:

If you cannot be able to remember your Capital One bank online access sign-in details at the time of sign-in or your sign-in details lost then you have to recover them for your security. And the recovery procedure is very easy and illustrated underneath in simple steps.

- Visit the official website of Capital One by browsing this link www.capitalone.com

- After reaching the website you have to click on the hyperlink designed as “Forgot Username or Password?” under the Password box.

- And then start the account finding procedure by entering the details like Last name, Social Security Number, and Date of Birth.

- After that click on the “Find Me” button and complete the rest actions to find your details.

Capital One Credit Card Bill Payment:

If you start using a credit card then you have to pay the bill of that particular credit card before your due date. And you can pay your credit card bill in four ways online by mobile app, by telephone, and by mail.

Online:

- To pay your Capital One Credit Card bill online you have to visit the official website of Capital One by browsing this link www.capitalone.com

- Then complete the sign-in process to enter your account and then follow the directions to pay your credit card bill by entering your card details and payment details.

By Mobile App:

- Also, you can pay your Capital One credit card bill through the Capital One bank’s mobile app.

- And to use this process you have to open the play store for android phones or the app store for iOS phones.

- After that download the Capital One online or mobile banking app.

- Next, complete the login process by using the username and password.

- And then pay your due bill by following the directions.

By Telephone:

If you cannot be able to do the above-mentioned procedures to pay your Capital One Credit Card bill then you can use this way to pay your card bill which is to make a call. To use the telephonic way, you have to dial 1-800-227-4825 and follow the instructions to pay your Capital One Credit Card bill.

By Mail

You can send your payment by mail also. for sending your credit card bill by mail you have to send your payment check including your account number to the below-stated mailing addresses.

Capital One Credit Card Customer Service:

Attn: Payment Processing

PO Box 71083

Charlotte, NC 28272-1083

OVERNIGHT ADDRESS

Capital One

Attn: Payment Processing

6125 Lakeview Rd

Suite 800

Charlotte, NC 28269

Contact Information:

Capital One

1-877-383-4802

1-800-227-4825

Reference:

www.capitalone.com/credit-cards