Guidelines For CFE Federal Credit Union To Apply For A Home Loan

Your home is the heaven you want to build. Not always everyone has the finance support for building a house. For that home loans are there. CFE is an American financial assistance providing company which is member-owned, as well as not-for-profit based as well. It has been working for years to provide many kinds of the financial co-operative services like the opening of an account, applying for the home loan, applying for the auto loans, and many other kinds of the loans as well.

If you want to apply for the loan or want to get other help such as sign in, you can look at the following information.

Apply for mycfe home loan

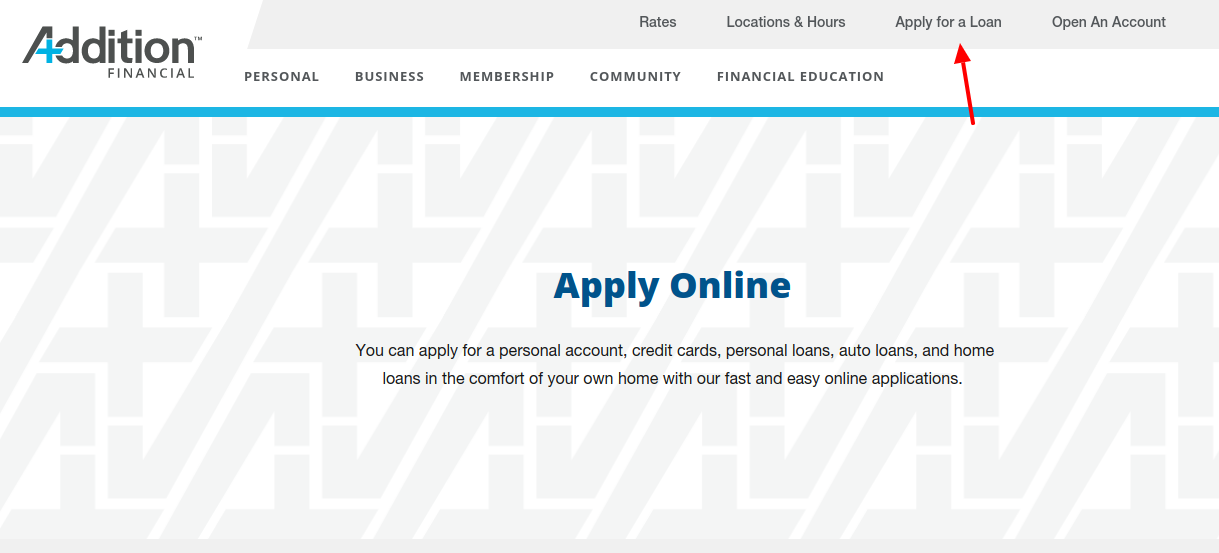

To have this visit, www.mycfe.com/apply

-

Here, at the top menu panel, click on, right side, ‘Apply for a loan’.

-

You will have to scroll down on the same page and at the middle right side click on, ‘Apply now’ under the tag, ‘Home loans’.

In the next page at the middle left side type,

-

Loan Purpose

-

Loan Amount

-

State

-

County

-

City

-

Property Use

-

Property Type

-

Credit Score

-

Then, click on, ‘Get quotes’.

Loan rates in CFE

Mortage rates (Interest rates, Loan APR, Loan points)

-

30 Year First Time Homebuyer: 3.875% : 4.006%: 0.000

-

5 Year Fast Track Refinance Mortgage: 3.000%: 3.197%: 0.000

-

10 Year Fast Track Refinance Mortgage: 3.500%: 3.603%: 0.000

-

10 Year Fixed Rate: 3.500%: 3.728%: 0.000

-

15 Year Fixed (Low Closing Cost): 3.875%: 4.034%: 0.000

-

15 Year Fixed Rate: 3.625%: 3.783%: 0.000

-

20 Year Fixed (Low Closing Cost): 4.000%: 4.125%: 0.000

-

20 Year Fixed Rate: 3.750%: 3.931%: 0.000

-

30 Year Fixed (Low Closing Cost): 4.125%: 4.216%: 0.000

-

30 Year Fixed Rate: 3.875%: 4.006%: 0.000

-

3/1 Year Adjustable Rate: 3.375%: 4.275%: 0.000

-

5/1 Year Adjustable Rate: 3.500%: 4.190%: 0.000

-

7/1 Year Adjustable Rate: 3.625%: 4.149%: 0.000

-

10/1 Year Adjustable Rate: 4.000%: 4.274%: 0.000

Undeveloped Land (Lot Loan): 8.250%: 10.472%: N/A

Home Equity Loans (Interest rates as low as, APR)

-

First-Lien HELOC: 5.000%: 5.000%

-

Second-Lien HELOC: 5.000%: 5.000%

Second Mortgages Maximum term, Rtaes as low as, APR as low as)

-

Second Mortgage: 60 Months: 3.625%: 3.823%

-

Second Mortgage: 120 Months: 3.750%: 3.853%

-

Second Mortgage: 180 Months: 5.125%: 5.199%

Additional info on CFE home loan

-

This is a totally online lending service. Most traditional lenders employ loan officers who meet with borrowers in person to take loan applications and are generally paid on commissions. Since you will complete their online application, there’s no need for a commissioned loan officer. CFE pass on those savings to you by providing the lowest rates and fees available!

-

Instead of a loan officer, they’ll assign your file to a Loan Specialist who will be available by phone, e-mail, or online chat to answer any questions you may have and to guide you through the mortgage process.

-

For a refinance or purchase application, there is no application fee.

-

For a pre-approval prior to house hunting, we do not charge a fee to process a pre-approval application.

-

If you’re looking for a mortgage it may be tempting to pick up the phone book or to visit your local bank, after all that’s how people have done it forever. Before you do – check out some of the advantages of shopping online for a mortgage.

-

Rates and fees are lower.

-

Typically, online lenders offer rates that are 1/8% to 1/4% lower than traditional lenders. This is a real monthly interest cost savings that could easily add up to $1000 in the first few years of your loan. How is this possible? Generally, online lenders do not have to pay a commissioned loan originator when you complete your application online. They can pass this savings on to you by offering lower rates.

-

Faster, easier comparison shopping.

-

To get an accurate cost comparison of traditional lenders you need to contact each of them and spend time collecting the appropriate data to decide who has the best mortgage available. That in itself can be pretty time consuming, and to top it off, interest rates can change daily. If you don’t get all your quotes the same day you still may not know who has the best rate. The web makes getting an apples to apples mortgage comparison easier than ever!

-

Apply at your convenience.

-

There’s no need to make an appointment with a loan officer when you choose an online lender. You can complete the loan application in the morning or at midnight in the convenience of your own home without any pressure to make a final decision until you are ready!

-

Personal Assistance whenever you need it.

-

All online lenders offer personalized support during the entire loan process. At anytime, you can call or e-mail a Loan Specialist who can answer your questions or provide some advice. Some of the lenders also provide online status information that is available 24 hours a day – you won’t have to wait for a loan officer to call you back.

-

Whether you’re purchasing or refinancing, CFE is certain you’ll find our service amazing!

-

If you’ll be purchasing but haven’t found the perfect home yet, complete our application and they’ll issue an approval for a mortgage loan now with no obligation!

-

The maximum percentage of your home’s value depends on the purpose of your loan, how you use the property, and the loan type you choose, so the best way to determine what loan amount we can offer is to complete our online application!

-

CFE offer manufactured home financing. The home must be a doublewide and newer than 1976. Other restrictions apply. Contact our Loan Specialists to determine if the home meets our minimum standards.

Enroll with CFE

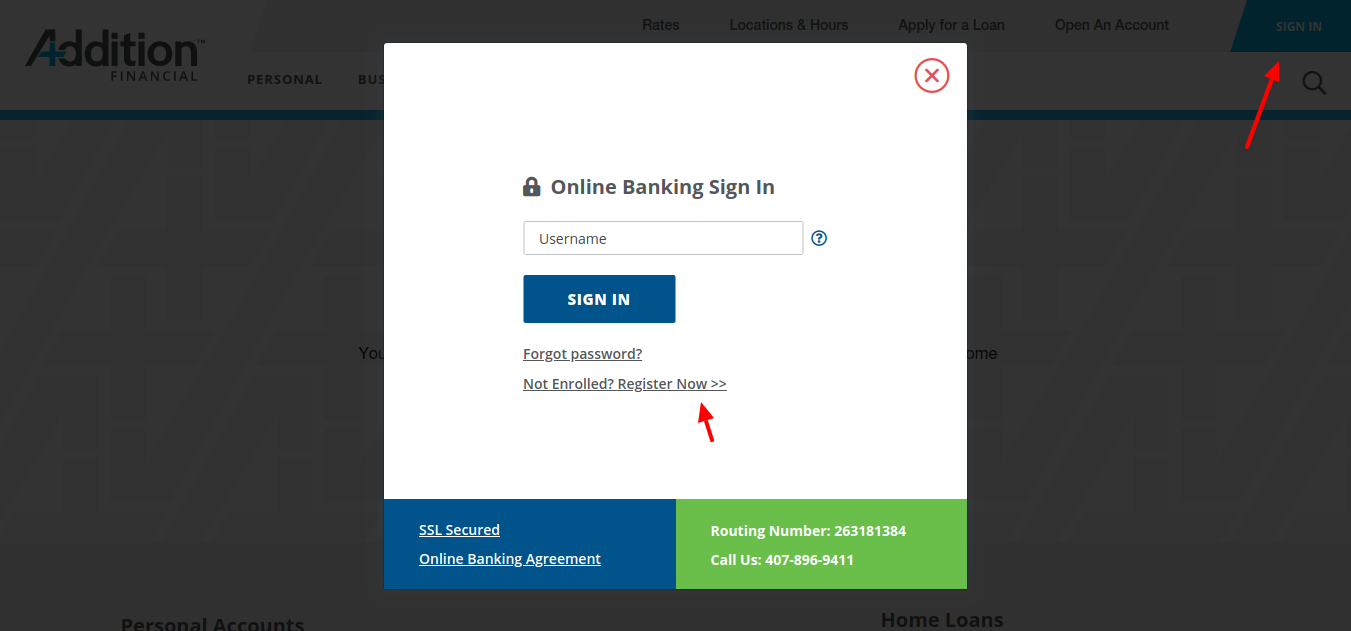

To get enrolled go to, www.mycfe.com/apply

-

Here, at the top right corner click on, ‘Sign in’.

-

You will get a box, here, under the sign-in button, click on, ‘Not enrolled? Register now’.

-

You will be taken into a new tab. Here, scroll down a bit and at the middle you will get two option for registration, personal or business.

-

For Personal registration, click on the left side one.

In the directed page, type,

-

Member/Account Number

-

First Name

-

Last Name

-

Home Phone

-

Soc Sec Num

-

Birth Date

-

Then from bottom left click on, ‘Submit’ in blue.

For business registration, click on right side button.

In the directed page enter,

-

Account Number

-

Business Name

-

Business Phone

-

SSN/TIN

-

Then from bottom left click on, ‘Submit’ in blue.

Sign in for CFE

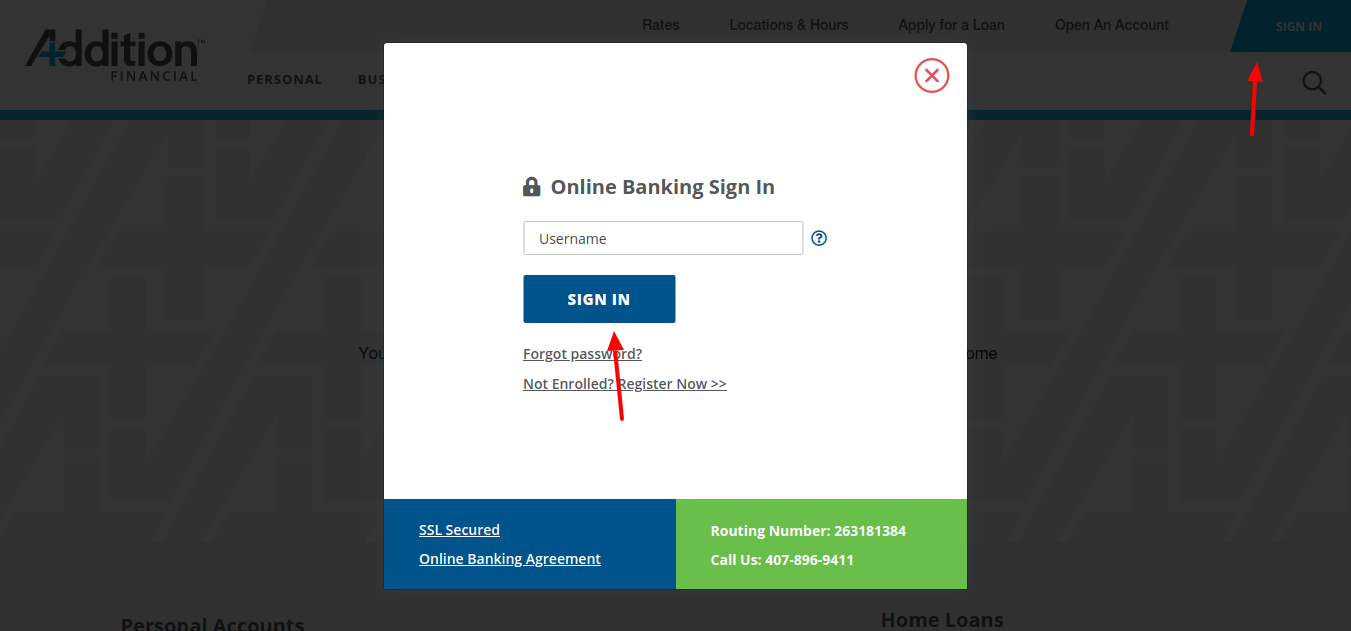

To sign in, go to, www.mycfe.com/apply

-

Here, at the top right corner click on, ‘Sign in’.

-

You will get a box, here, type,

-

The username

-

Then, click on, ‘sign in’.

You will be logged in.

Forgot password

If you have forgotten the password, then in the login box, under sign in, click on, ‘Forgot password?’.

-

In the new tab, at the middle left side input,

-

Login ID:

-

Account #:

-

e-mail:

-

Then, click on ‘Submit’.

You have to check the instructions after this to get the password.

Also Read : Hilton Garden Vacation Club Account Login Guide

More info on CFE loans

-

CFE routing number is 263181384.

-

You may change your address by calling us at 407-896-9411 or 800-771-9411 (outside Orlando). Or visit any branch location with new proof of residency.

-

You can make a loan payment online via your online banking account, over the phone or in person at any of our branch locations.

-

Addition Financial has contracted with another call center who will take our overflow calls. This minimizes the hold time for our members and gives our members after-hours support. If the member service representative is unable to answer your question, they will submit a service event/ticket and an Addition Financial representative will respond to you directly.

-

To get your free box of checks, you must give us a call at 407-896-9411 or 800-896-9411 and request the free box. If you order checks online, you will be charged.

-

If your address has changed since your last check order, please give us a call at 407-896-9411 or 800-896-9411 and we will order the checks for you. Only use the check order online if the information has not changed since your last check order.

-

Call the credit card fraud department at 800-235-7728. The phone number is also listed on the back of your credit card.

-

Log in to online banking and select “dispute/fraud debit card transactions” or come into a branch.

-

You must use your routing number and either your checking account number or savings account number.

-

You have to reach out to the other financial institution to cancel the payment. If they are unable to cancel the payment please either stop by a branch or give us a call to complete a Written Statement of Unauthorized for Unauthorized/Improper ACH Debit Debit Activity. This form needs to be signed before the funds can be returned to your account.

-

When you swipe your card at the pump, the merchant will automatically hold $100. If you don’t have $100 in your account, courtesy pay kicks in and you could be charged a fee. To avoid this, go inside and swipe your card inside.

Customer help

To get in touch with CFE, you will get these calling and Fax options,

-

407-896-941- Local

-

800-771-941- Toll-free

-

407-333-792- Fax

For lost or Stolen Cards

-

866-820-5853- Toll-free

-

727-299-244- Outside U.S.

Reference :