Capital One has been classified as the best commercial banking and finance management around the world. It provides banking services, loans, guidance, credit card facility and so other services. Among all of these services, we are going to highlight on the credit card use and how to monitor it through the online portal here.

Capital one was initiated as a commercial bank but later it is specialized in the provision of loans and credit card facilities to its customers. It has ranked 17th among the top 100 companies and headquartered in McLean, Virginia. It operates its services throughout the United States and comes Part of Canada.

Customers, who wish to monitor the use of capital one credit card, can avail the online account login. Customers can easily make a transaction and purchases by using this credit card. There are various portals for different services and types of credit card. We will guide our readers through the post so that they can access it easily.

Why toChoose Capital One Credit Card:

If you are looking for a credit card which suits your financial needs then you can opt for Capital One Credit card. You can choose the capital one credit card for the below reasons.

- Great cash back on purchases.

- Unlimited rewards on every purchase.

- Helps to build good credit health.

- Low annual percentage rate.

Eligibility Criteria for Capital One Credit Card:

To apply for a capital one credit card you should meet the below eligibility criteria.

- You need to be more than 18 years.

- You have a credit score of more than 700.

- Need to be a legal resident of US.

You can check if you are prequalified or not by click on the link www.capitalone.com/credit-cards/prequalify.

Please note, the prequalifying test does not impact on your credit score.

Types of Capital One Credit Card:

Capital One has a selection of credit cards according to his customer’s need. The featured credit cards of capital one are:

- Capital One Venture Credit Card:Those who are looking for travel reward card Capital One Venture Credit Card is best for them.

- Benefits:

- No Foreign Transaction Fees: You do not have to pay any transaction fee when you are making any payment outside of US.

- Auto Rental Collision Damage Waiver:You can rent a vehicle with your credit card and if any damage happens to the vehicle due to the collisionor theft then that will be waived off.

- 24-Hour Travel Assistance Services:If you lost your credit card then you can get an emergency replacement.

- Extended Warranty:You will get an extended warranty at no cost.

- Benefits:

- Capital One Quicksilver Reward Credit Card:With capital one quicksilver reward card earns unlimited 1.5% cash back on every purchase and also earn a one-time $150 cash bonus once you spend $500 on purchases within 3 months from account opening.

- Benefits:

- Extended Warranty:You’ll get additional warranty protection at no charge on eligible items that are purchased with your credit card.

- No Foreign Transaction Fee: there is no foreign transaction fee for making payments outside the US.

- Auto Rental Collision Damage Waiver:You can rent a vehicle with your credit card and if any damage happens to the vehicle due to the collisionor theft then that will be waived off.

- 24-Hour Travel Assistance Services:If you lost your credit card then you can get an emergency replacement.

- Benefits:

- Capital One Savor Rewards Card:With Capital One Savor Rewards Card you will get unlimited 4% cash back on dining and entertainment, 2% at grocery stores and 1% on all other purchases.

- Benefits:

- Price Protection: Purchase an item and find a lower price within 120 days and you could be reimbursed for the price difference.

- Complimentary Concierge Service: Enjoy comprehensive, personalized assistance in dining, entertainment and travel 24 hours a day, 365 days a year.

- 24-Hour Travel Assistance Services:If your credit card is lost or stolen, you can get an emergency replacement card and a cash advance.

- Fraud Coverage:You’re covered by $0 Fraud Liability if your card is ever lost or stolen.

- Card Lock:If you misplace your credit card, you can instantly lock your card.

- Benefits:

Rates and Fees of Capital One Credit Card:

- Annual Percentage Rate:

- Annual Percentage Rate For Purchases And Transfers: 15.24%, 21.74% or 25.24%, based on your creditworthiness.

- Annual Percentage Rate For Cash Advances: 25.24%

- Fees:

- Annual Fee: $0 intro for the first year, $95 thereafter.

- Transfer Fee:3% of the amount of each transferred balance.

- Cash Advance:Either $10 or 3% of the amount of each cash advance, whichever is greater.

- Late Payment: Up to $38

How to Apply For Capital One Credit Card:

If you are convinced with the benefit of the Capital one credit card and want to apply for one then you should follow the below process:

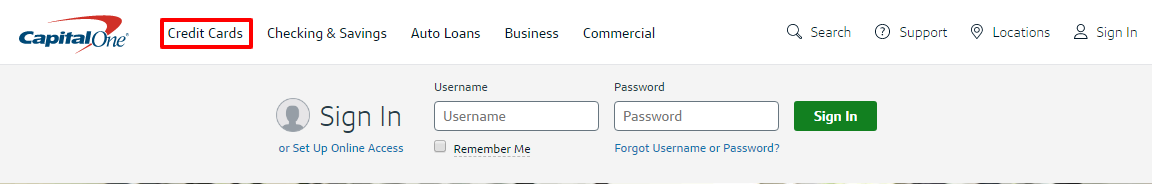

- Open the official website with the link www.capitalone.com

- Click on the Credit card option.

- Select the card type.

- Click on the “Apply Now” option.

- Enter your first name, last name, date of birth social security number, your contact information, financial information and then click on the “Continue” option.

Login Procedure of Capital One Credit Card Account:

Once you receive your card, you will be able to use this card at various places such as general stores, fuel stations or any places where car payment is allowable. It is necessary to manage the use of your cards as it controls your finances. To login to your account you should follow the below steps:

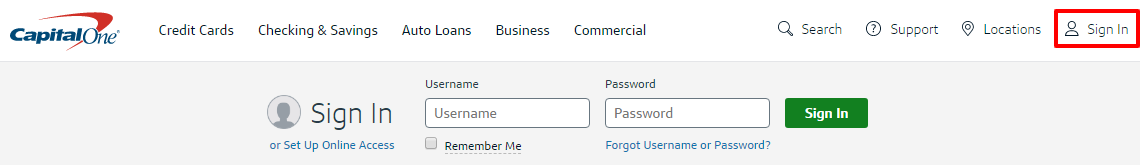

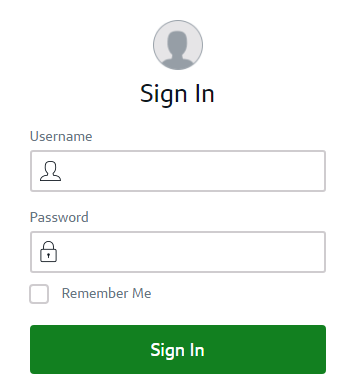

- Open the official website with the link www.capitalone.com

- Click on the “sign in” option on the right corner of your website.

- Enter your user name and password then click on the “Sign In” option.

How to Reset Forgotten User Name and Password:

If you want to reset your forgotten user name and password then you should follow the below steps:

- Open the official website with the link www.capitalone.com

- Click on the “sign in” option on the right corner of your website.

- Click on the “Forgot User name and Password?” option.

- Enter your last name, social security number and date of birth then click on the “Find Me” option.

How to Sign Up To the Capital One Account:

To sign up to your capital one credit account you should follow the below process:

- Open the official website with the link www.capitalone.com

- Click on the “sign in” option on the right corner of your website.

- Click on the “Set up an online access” option.

- Enter your last name, social security number and date of birth then click on the “Find Me” option.

How to Activate Capital One Credit Card:

Applied for the capital one credit card and receive the same, but you need to activate your card before you use it. To activate your card you need to follow the below steps:

- Open the official website with the link www.capitalone.com

- Click on the Credit card option.

- Click on the “Activate your Card” option on the right side of your website.

- If you are an existing customer of capital one the click on the “Sign In” option, otherwise click on the “Enroll Here” option.

How to Pay Capital One Credit Bill:

To pay your capital one credit card bill you need to log in to your account first.

Contact:

- Customer Service: 1-800-CAPITAL (1-800-227-4825) (For servicing of existing accounts only)

- Outside the US, call collect: 1-804-934-2001

- Fraud Protection: 1-800-427-9428 or 1-800-239-7054

- Apply for a credit card: 1-800-695-5500

- Report death of a cardholder: 1-877-357-5659

- Small Business credit card: 1-800-867-0904

Reference:

www.capitalone.com/credit-cards/prequalify